Shifting gears, let’s address Churn Risk now.

Shifting gears, let’s address Churn Risk now.

In the previous chapter we plotted customers according to their short-term Purchase Propensity and their long-term Customer Lifetime Value, revealing an abundance of opportunity that is commonly overlooked, owing to how the industry at large operates.

However, we mustn’t become so obsessed with acquiring new customers and nurturing our high potential ones that we allow Churn to offset growth.

Churn is a well understood concept, so we’ll take a slightly different angle and cover:

- Newly acquired customers and the threat of one-and-done

- Programmai’s method for mitigating early signs of Churn

- To discount or not to discount

- It’s all in the timing

Acquiring healthy customers and avoiding one-and-done

Today, the customer controls the frame. Brands are losing their ownership of the relationship* and are increasingly trying to understand their customers and build loyalty through providing a better experience.

All retailers need growth, so it’s no surprise that acquiring new customers is almost always a top priority, but even the blue-chip brands suffer in today’s fickle, race-to-the-bottom culture where prices and services are getting leaner each year.

When I was at ASOS, we had an eye-watering issue with convincing newly acquired customers to purchase again, here’s a stat for you—

60% of newly acquired customers were coined “one-and-done” each year.

How does Programmai seek to solve this?

Machine learning doesn’t have an agenda, it lets the data lead. It doesn’t care for rationale, narrative or explaining why; it simply learns what has happened in order to predict when it’ll happen again.

For this retailer, on average the optimal time to stimulate second purchases at large is soon after the first to avoid the dreaded one-and-done label.

Chart: cumulative second orders over a rolling 12 months & when they occur

Over a rolling 12 month period, we observe that 50% of all second purchases have happened within 6 weeks from the date of the first purchase. It’s therefore very challenging to get newly acquired customers to purchase again if we fail to do so when the timing is most optimal.

Every consumer is unique, so how we plot them according to Churn Risk will vary. Some consumers will behave in a way that suggest Churn is not an issue, others will behave exactly like a consumer who, as above, failed to make it onto their second purchase.

The Reliance on Discounts

We see a large part of the problem is the discounts & incentives used to gobble up as many new customer purchases as possible.

This can train a behaviour in customers, as well as devalue products and services on offer, often unnecessarily. It’s therefore increasingly important to understand the type of consumer you’re dealing with from the off — which is something Programmai can help with.

The secret… TIMING!

Understanding when a consumer is in market is easy, the signals are there. But understanding them in a much deeper way is where machine learning can assist us, freeing us mortals up to be more creative and selective with messaging & offer.

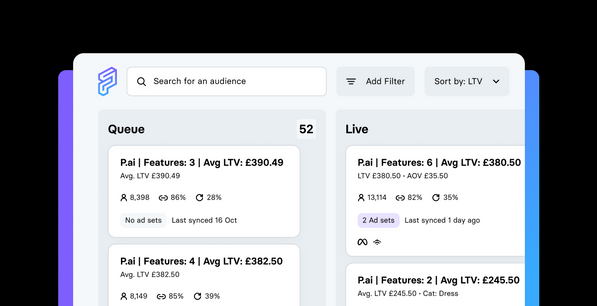

As we saw above, if we’re dealing with a consumer who fits our most generic use case we can expect to stimulate a second purchase 7 days from the first. What this is lacking is any notion of individual customer experience, good or bad. That’s why when Programmai is scoring an individual on their risk of Churn; we’ll do so on a vastly complex set of values. These deal with order returns, complaints, browsing behaviour and engagement pertaining to that consumer.

The following chart illustrates Churn Risk by the number of consumers currently at risk and therefore gives a target audience north of 60% risk.

Using this predictive audience segment you can mitigate Churn before it’s too late, not just in an attempt to stimulate a second purchase but throughout your entire customer base.

The results we have seen show that this method outperforms a control group by 25%.

We’ll be back soon, with an introduction to Recipes!

Stay tuned.

*https://hbr.org/2015/04/why-strong-customer-relationships-trump-powerful-brands