Welcome back, I hope you’re enjoying this series as much as I am writing it.

Welcome back, I hope you’re enjoying this series as much as I am writing it.

Let’s start you off with a quick recap.

In the last chapter, we showed you that by predicting the Purchase Propensity of every consumer and using it to determine how aggressively to market & advertise to each, you can drive up the overall incremental return while reducing the cost of acquisition.

Frankly, the feedback we received was that it sounded too good to be true. So let’s now build on that further by introducing our second model, Customer Lifetime Value.

What we’re going to cover:

- Why we want to predict CLV

- How does Programmai do it!

- Ways we can leverage CLV

- Where we think this is all heading

Why do we want to predict the CLV of every consumer?

Firstly, it’s becoming increasingly important for you to gain a deeper understanding of how each consumer is likely to behave and engage with your brand in the future. Doing so allows you to align key lifecycle moments and messaging to each consumer when the timing is most optimal for them.

Secondly, it again suggests the level of investment you can safely make in your marketing & advertising efforts to nurture consumers over much longer periods than any attribution or journey analysis can cover.

How does Programmai accurately predict future CLV?

Without repeating myself verbatim, we take in all first-party data events historically and in real-time (from session to engagement to transactional) to understand deeply what has happened in the past; such that we can predict what is likely to happen in the future.

One of the ways we technically differentiate, is in our ability to predict CLV before a consumer has made their first purchase. This is because we’re using a Neural Network to understand vastly complex interactions in your data, such as how this consumer is browsing, to describe them as similar to consumers that came before them (valuable or not).

Let’s now take a look at how you can use our CLV prediction

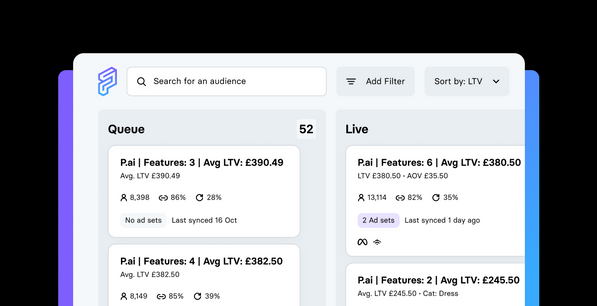

In this illustration, we’re using a combination of two Predictions to plot all consumers.

Let’s take one use case; to target consumers with high future CLV and stimulate frequency.

— Vertical axis plots future CLV over 12 months

— Horizontal axis plots PP over the next 14 days

— green box represents our opportunity area, for this use case

Viewing consumers in this way allows us to factor in short and long term behaviours when selecting our target audience.

If our goal is to capitalise on the future CLV of consumers not currently in a purchase journey, then we can make a case to target this upper-left quadrant — since these consumers are showing they’re ripe for investment.

We may want to express the economic value (EV) of a step in this journey, so that we can set our bid prices programmatically (as a percentage of the value):

Most direct response strategies only target consumers on the far right of the chart. This view offers us investment opportunities to massage the full funnel for the greater good.

It’s equally an ideal way for both brand & performance marketing teams to cooperate, by putting greater emphasis on the quadrants most relevant to their activities.

Our take on where this is all heading

Becoming the consumer’s brand of choice takes time and Programmai’s Platform can help guide high potential consumers through that journey with you.

While traditional ad-tech approaches optimise aggressively towards bagging the last click of already high propensity customers; tremendous value is available by focussing on the consumers who behave a lot like your best customers do, but have lower levels of engagement thus far.

If you wanted evidence that CLV is not only worth taking very seriously, but also to be used when making marketing & advertising decisions. You need only look at the emphasis both Nike and ASOS put on it in their respective areas.

Turning the page, we cover Churn Risk in our next chapter.

Stay tuned.